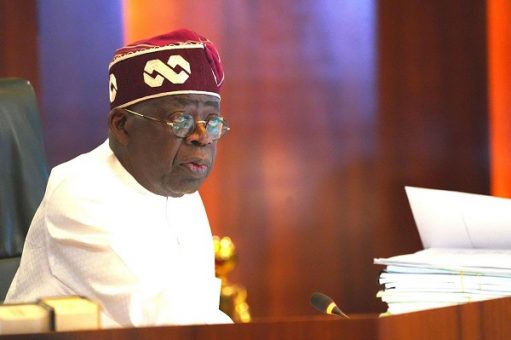

Abuja, January 1, 2026 — President Bola Ahmed Tinubu has assured Nigerians that the newly introduced tax laws, which officially commence today, will help build a fair, competitive and sustainable fiscal foundation for the country and deliver shared prosperity across all sectors of the economy. The Nation Newspaper+1

In his New Year message, the President emphasised that the tax reforms are not intended to overburden citizens but to harmonise Nigeria’s fragmented tax system, eliminate multiple taxation, and strengthen the government’s capacity to finance infrastructure and social investments. The Nation Newspaper

“By harmonising our tax system, we aim to raise revenue sustainably, address fiscal distortions and strengthen our capacity to finance infrastructure and social investments that will deliver shared prosperity,” President Tinubu said. The Nation Newspaper

The President also commended state governments that have aligned with the national tax harmonisation agenda, noting that their cooperation has reduced excessive levies and fees on citizens and businesses. The Nation Newspaper

Tinubu acknowledged the economic challenges of recent years but said the reforms of 2025 have started yielding measurable gains despite global headwinds. He expressed confidence that ordinary Nigerians will begin to feel the benefits more distinctly in the coming months. The Nation Newspaper

As part of a broader inclusive growth strategy, the President unveiled an initiative targeting 10 million Nigerians through empowerment programs in agriculture, trade, food processing and mining, with 1,000 beneficiaries in each of the nation’s 8,809 wards. The Nation Newspaper

The reforms follow the comprehensive Tax Reform Acts signed into law on June 26, 2025, which include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Act, and the Joint Revenue Board Act — all aimed at modernising tax administration and boosting government revenue. PwC

Despite political controversy in late 2025 — including calls by opposition parties for suspension due to alleged discrepancies between the harmonised and gazetted versions of the laws — the Federal Government reaffirmed implementation as scheduled, stressing that no substantive issue justified delaying the reforms. THISDAYLIVE