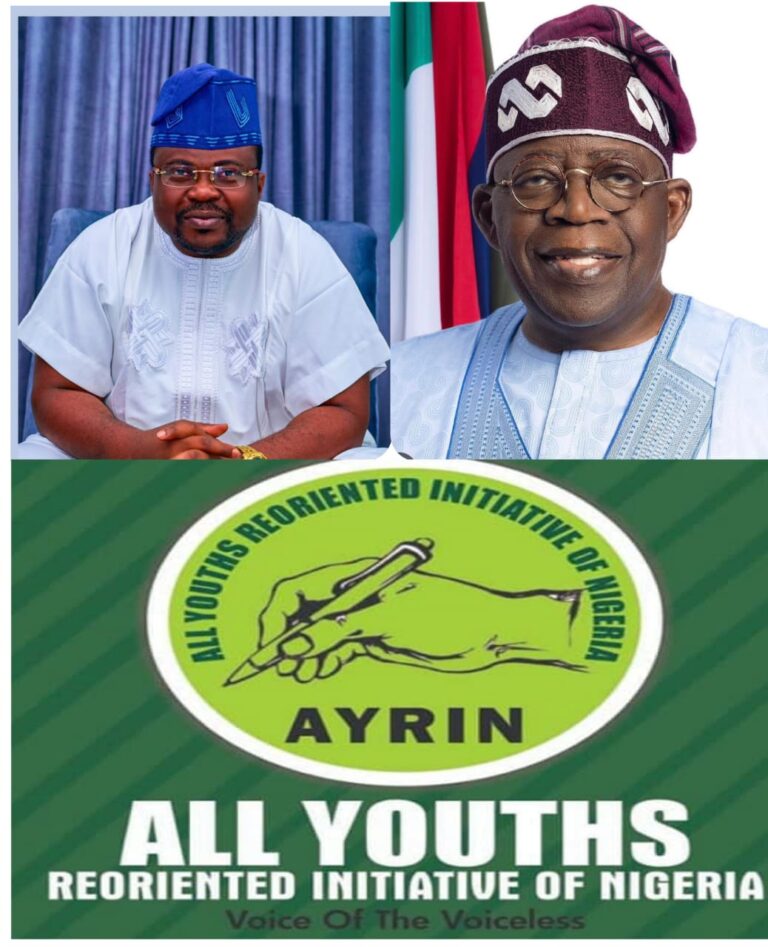

The President of the All Youths Reoriented Initiative of Nigeria (AYRIN), Amb. Olufemi Ajadi Oguntoyinbo, has called on the President Bola Tinubu-led Federal Government to clearly explain the benefits Nigerians stand to gain from the newly introduced tax measures, warning that continued taxation without visible economic relief could further impoverish citizens.

Ajadi made this known in a strongly worded statement on Monday, where he criticized what he described as a growing culture of revenue extraction without corresponding investment in infrastructure, security, and economic empowerment.

“You cannot keep obtaining from Nigerians without first making the country conducive for economic activities to thrive,” Ajadi stated. “Taxation should be a tool for development, not punishment.”

Ajadi expressed deep concern over the cumulative burden placed on Nigerians, particularly workers and small business owners, noting that banks are already deducting charges from personal savings while inflation continues to erode purchasing power.

“Banks have been deducting money from Nigerians’ personal savings. What else do you want from the people by imposing a new tax law that also affects individual savings?” he queried.

According to him, Nigerians are yet to recover from existing deductions, including the 7.5 per cent Value Added Tax (VAT) and other statutory levies, making the timing of a new tax regime economically insensitive.

“We already have an established personal income tax structure. Nigerians deserve to know how this new tax will benefit them. Don’t tell us only how to collect taxes—tell us how Nigerians will benefit,” Ajadi stressed.

The AYRIN president also faulted the Federal Government over the removal of fuel subsidy, arguing that Nigerians have not seen any tangible benefits from the policy.

“The subsidy money that was removed—where is the impact? Nigerians have not seen improvements in infrastructure, transportation, healthcare, or education,” he said.

He warned that introducing new taxes without demonstrating accountability for previous economic sacrifices could further widen the trust gap between citizens and the government.

In a bold political demand, Ajadi urged members of the House of Representatives and the Senate to initiate a constitutional amendment that would remove immunity for future presidents beginning from 2027.

“From the next administration, the president should no longer enjoy immunity,” he declared. “No one should be above the law in a democracy.”

According to him, removing immunity would promote accountability, transparency, and responsible governance.

Ajadi also condemned the withdrawal of security personnel from VIP convoys, describing it as poorly thought out and dangerous.

He cited a recent incident involving international boxing champion Anthony Joshua, whose vehicle was reportedly involved in an accident allegedly due to the absence of a security pilot vehicle.

“If a security van had been leading the convoy, the accident could have been averted,” Ajadi said. “This policy has exposed both VIPs and ordinary Nigerians to increased risk up to date.”

The AYRIN president further questioned the effectiveness of road safety enforcement agencies, particularly the Federal Road Safety Corps (FRSC) and the Vehicle Inspection Office (VIO), noting that while vehicles are routinely checked for roadworthiness, little attention is paid to the condition of Nigerian roads.

“FRSC and VIO ensure vehicle worthiness, but who certifies that our roads are worthy to be used?” he asked.

While acknowledging the statutory roles of FRSC at the federal level and VIO under state ministries of transport, Ajadi argued that poor road conditions, potholes, and abandoned highways contribute significantly to road accidents across the country.

Ajadi warned that the new tax initiative could worsen the living conditions of Nigerians if implemented without safeguards. He listed possible consequences to include reduced household savings, increased cost of goods and services, business closures, job losses, and higher poverty levels.

“Tax policies that do not consider the realities of the people will only deepen hardship,” he said. “The government must prioritise economic stability, security, and infrastructure before imposing additional financial burdens.”

He urged the Federal Government to engage Nigerians transparently, carry out broad consultations, and ensure that taxation is matched with visible development outcomes.

Source; PM News