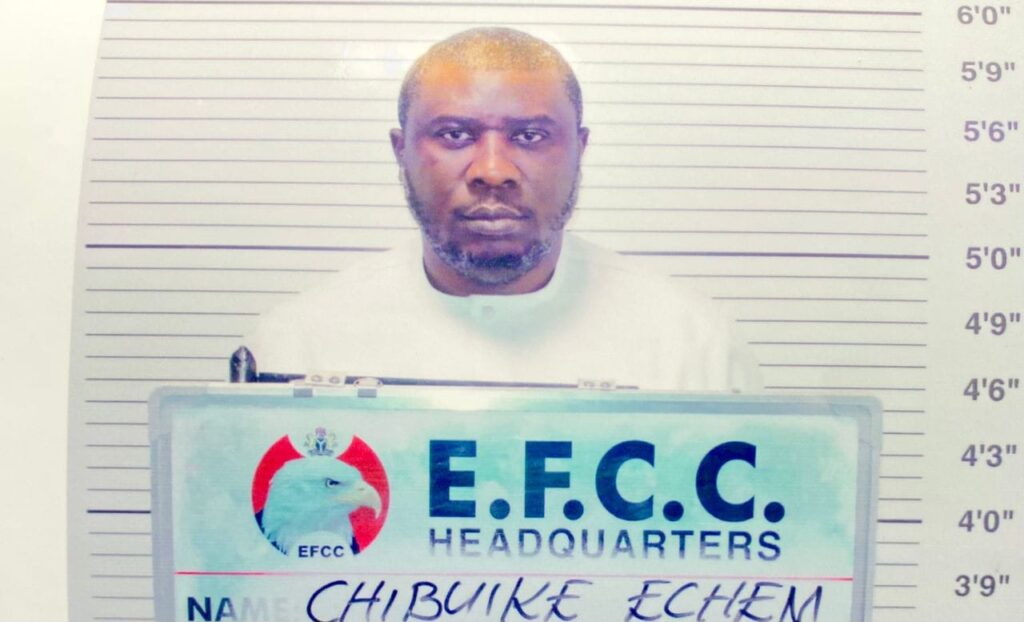

The Economic and Financial Crimes Commission (EFCC) on Tuesday arraigned the Chief Executive Officer of Bondpay, Prince Chibuike Echem, alongside a former National Coordinator of the Multi-Sectoral Crisis Recovery Project of the North-East Development Commission (NEDC), Danjuma Mohammed, over an alleged N2.28 billion advance fee fraud and forgery scheme.

Echem and Mohammed were docked before Justice Keziah Ogbonnaya of the Federal Capital Territory High Court sitting in Zuba, Abuja, on a 54-count amended charge bordering on conspiracy, false pretence, advance fee fraud and forgery. A third suspect, Aminu Alhaji, is said to be at large.

According to the EFCC, the alleged offences were committed between 2022 and 2024 and involved the purported defrauding of an indigenous construction and equipment supply firm, Diamond Leeds Limited.

Court documents show that Echem, listed as the second defendant in charge number CR/708/25, allegedly presented himself as a contract facilitator with access to high-level officials within key government agencies, including the NEDC.

The anti-graft agency alleged that he played a central role in introducing Diamond Leeds’ Chairman, Kenneth Ejiofor Ifekudu, to Danjuma Mohammed, who was portrayed as a powerful decision-maker capable of influencing contract awards in the North-East.

One of the charges alleges that between May 2022 and February 2024, Echem, Mohammed and the fugitive Aminu Alhaji conspired to obtain the sum of N2.28 billion from Diamond Leeds under false pretences, an offence punishable under the Advance Fee Fraud and Other Fraud Related Offences Act, 2006.

In a specific count, the EFCC alleged that Echem’s Wema Bank account was used to receive an aggregate sum of N573.5 million from Diamond Leeds in 2023, on the claim that the funds were required to facilitate and execute contracts under the Multi-Sectoral Crisis Recovery and Stability Programme of the NEDC—claims investigators say were false.

Despite allegedly issuing Diamond Leeds with contract award letters, EFCC investigations revealed that the company was never allowed to deploy engineers or equipment to any project site in the North-East. Mohammed was said to have repeatedly cited insecurity as the reason for the delay.

The anti-graft agency further alleged that all contract documents presented to Diamond Leeds were forged and that a syndicate later opened a Guaranty Trust Bank account bearing the acronym “NEDC”, through which portions of the funds were returned to the victim company under the guise of payment for equipment supplies.

When the charges were read in court, Echem and the other defendants pleaded not guilty to all counts.

Following the plea, prosecution counsel Olarenwaju Adeola applied for the defendants to be remanded in custody pending trial. However, defence counsel Chukwuka Obidike informed the court that a bail application had already been filed.

The prosecution opposed the immediate hearing of the bail request, stating that it had only been served the previous evening and required time to respond.

Justice Ogbonnaya agreed, ordering that the defendants be remanded at the Suleja Correctional Centre and adjourned the matter to March 25 for hearing of the bail applications.

Speaking after the proceedings, lead counsel to the nominal complainant, Beth Igwilo (SAN), disclosed that seven witnesses would testify during the trial.

Diamond Leeds also expressed disappointment that Echem, who allegedly benefited from the company’s goodwill, was accused of conspiring with others to defraud it.

The EFCC said further investigations uncovered additional alleged fraudulent activities linked to Danjuma Mohammed, developments which reportedly led to his eventual removal from the NEDC.

Source; PM News