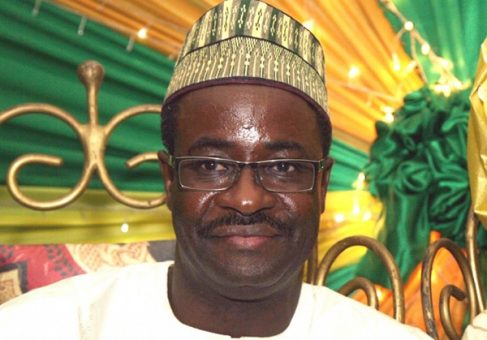

The Director-General of the Budget Office of the Federation, Tanimu Yakubu, has dismissed what he described as “wrong notions and stage-managed arithmetic” surrounding Nigeria’s new tax laws, saying claims that the reforms would impose fresh burdens on the poor were based on selective accounting and misrepresentation of the law.

Yakubu, in a detailed rejoinder to a widely circulated essay critical of the tax reforms, argued that the narrative branding the policy as “Bola’s tax” deliberately ignored key provisions designed to shield low-income earners.

He said the argument relied on emotional framing rather than the actual structure of the tax schedule approved under the new regime.

At the centre of the controversy, according to the Budget Office chief, is what he called a “category error” in which pension and health insurance contributions were wrongly presented as taxes.

He stressed that pension payments are deferred wages owned by workers and lodged in their Retirement Savings Accounts, while health insurance premiums are contributions that purchase defined coverage, not compulsory levies for general government spending.

“A deduction is not a tax, and a contribution you own is not a levy you lose,” Yakubu said, adding that such deductions, in fact, reduce taxable income and demonstrate an effort to protect workers’ welfare rather than exploit it.

Yakubu said the most critical omission in the criticism was the ₦800,000 annual tax-free threshold under the new personal income tax structure, explaining that the first ₦800,000 of annual income attracts a zero per cent tax rate, a provision he described as “the hinge on which liability turns.”

Using an illustrative example of a worker earning ₦75,000 monthly, Yakubu noted that such a person earns ₦900,000 annually, placing only ₦100,000 above the zero-rated band.

Even at a 15 per cent rate on that excess, he said the tax exposure would amount to ₦15,000 a year, before deductions, adding once pension contributions are applied, the taxable portion drops sharply and could fall to zero if other allowable deductions, such as health insurance, are included.

He also faulted the use of global poverty lines in the criticism, saying the World Bank’s $4.20-a-day benchmark was a purchasing power parity (PPP) measure, not a nominal wage threshold that could be converted directly into naira using market exchange rates, saying such conversions turned technical welfare metrics into political talking points.

Addressing the claim that “widening the tax base” necessarily meant taxing the poor, Yakubu described it as a false syllogism.

He said tax base expansion could involve bringing non-compliant high earners into the net, closing loopholes, capturing affluent segments of the digital and informal economy, and strengthening employer withholding, rather than targeting subsistence incomes.

Yakubu further argued that long lists of alleged corruption and mismanagement, while raising legitimate governance concerns, did not invalidate the structure of a tax schedule.

He said the logical response to accountability concerns was to improve transparency, auditing, and enforcement, not to misrepresent tax reforms aimed at reducing Nigeria’s reliance on borrowing.

“The outrage depends on omitting the very thresholds and concepts that make its conclusion collapse,” Yakubu said, insisting that the new tax structure explicitly protects low incomes and that claims to the contrary were driven more by narrative devices than by arithmetic grounded in law.

Source; The Nation News